Perched on a sofa final April in a personal room inside Chanel’s sprawling area at Watches & Wonders, Frédéric Grangié and Arnaud Chastaingt seem positively serene. Exterior, the world’s largest watch truthful buzzes with power as press, retailers, and VIP shoppers collect for a first-hand glimpse of the newest from a large swath of manufacturers, together with the business’s largest hitters. In contrast to at Paris Style Week, the place Chanel is perpetually one of many hottest invitations on the town, right here in Switzerland the maison’s iconic brand would possibly truly be an obstacle. The style home should vie for consideration with horological heavyweights corresponding to Patek Philippe and Rolex, which dominate the panorama and have catalogs of coveted fashions courting again a whole lot of years. However Grangié, Chanel’s president of watches and fantastic jewellery, and Chastaingt, director of its Watchmaking Creation Studio, are unfazed. They insist that Chanel’s recent perspective, mixed with an incomparable vogue historical past and laser give attention to savoir faire, truly provides the home a bonus on the earth of haute horology.

“Once we have a look at competitors—and we’re very respectful of them—a number of the homes have been there for 2 centuries, some declare much more, however we’re nonetheless in that part the place every little thing that we’re creating is definitely a part of a residing patrimony,” Grangié says. “We see the distinction in what we’re presenting as a result of, after all. The most important mistake that we may have made is to be a vogue firm making watches, versus a watchmaker whose manufacture and craftsmanship is on the service of creation.”

Chanel didn’t enter the watch area till 1987, however within the brief time since, it has turn into a trailblazer by way of each innovation and creativity. Its J12 X-Ray, which debuted in 2020, was the primary timepiece to function a case and bracelet constructed from clear sapphire crystal; sometimes used to cowl watch dials, the fabric is so onerous it will probably solely be machined with diamond-tipped instruments. It’s additionally extraordinarily costly and tough for corporations to supply. Slicing-edge watch manufacturers corresponding to Hublot, Richard Mille, and Bell & Ross (during which Chanel has a minority stake) had produced the fabric for a few of their particular high-end circumstances, however the J12 marked the primary time a sapphire-crystal bracelet had appeared available on the market. “We had a competitor, an important one, come to us right here, and once they noticed it they mentioned, ‘We tried to do it and it was a nightmare,’” Grangié recollects, chuckling and including, “I can verify it’s a nightmare.” However, Chanel adopted up this 12 months with a model in pink sapphire crystal, much more tough because of the formidable problem of sustaining shade consistency throughout the restricted version of 12. It’s only one instance of how Chanel—alongside different vogue and jewellery homes from Bulgari and Van Cleef & Arpels to Hermès and Louis Vuitton—is elevating its watchmaking sport, giving manufacturers with centuries-old horological historical past a run for his or her cash within the course of.

Bulgari Octo Finissimo Extremely BVL 180 motion measuring simply 1.50 mm thick

Courtesy of Bulgari

Watches was an afterthought for luxurious manufacturers seeking to broaden their life-style portfolios. At jewellery homes, timepieces provided male shoppers a cause to deal with themselves whereas shopping for baubles for his or her vital others, or they had been seen as a mass-marketing instrument, a way of attractive shoppers who won’t have the ability to afford a million-dollar high-jewelry necklace or five-figure purse. However as social media started luring a whole new technology of watch lovers—a pattern that accelerated vastly through the pandemic—luxurious homes started taking the class extra severely, seeing the long-term potential of upping the ante on each design and technical actions and rising their investments accordingly. The consequence has been a number of the most artistic and difficult watchmaking occurring wherever in Switzerland—even when collectors have been gradual to acknowledge it.

The race to compete for headline-grabbing horological feats has turn into fierce, and a number of the creations defy perception. Take the continued tug-of-war between two homes with jewellery roots, Bulgari and Piaget, over laying declare to essentially the most sophisticated timepieces within the thinnest attainable circumstances. Piaget took ultrathin engineering to a brand new stage in 2018 when it created the Altiplano Final Idea, the thinnest mechanical watch on the earth on the time, measuring an unbelievable 2 mm thick; the earlier file holder, the Grasp Extremely Skinny Squelette from longtime conventional watchmaker Jaeger-LeCoultre, abruptly appeared hefty at 3.6 mm. Simply 4 years later, Bulgari one-upped Piaget with its Octo Finissimo Extremely, which slimmed all the way down to a mere 1.8 mm thick—a literal hair thicker than 1 / 4, regardless of packing 170 parts and 50 hours of energy reserve. It marked Bulgari’s eighth world file for thinness within the Octo Finissimo line. Some contemplate it a gimmick, however the race to scale back gave the corporate bragging rights over elite watchmakers in an business the place it’s onerous to face out.

“I keep in mind very nicely once I mentioned, ‘Why does a consumer as we speak have to purchase a Bulgari watch?’ ” says the corporate’s product creation government director, Fabrizio Buonamassa Stigliani, recalling the early days when the Octo Finissimo was simply an concept. “We aren’t linked with any path. We don’t comply with the game mannequin. We aren’t in golf or in polo. We aren’t in aviation,” he notes. The label did have the Bulgari Bulgari timepiece, a profitable branded vogue watch from the ’70s that was revived this 12 months, however he says he started difficult the chief staff to green-light extra sophisticated items. Nobody had anticipated them to have the ability to create a motion at that stage, and but “we have now this manufacture inside, and we’re in a position to create essentially the most ultrathin watches,” so why not use it to their benefit? “We began to make use of the story of [setting] the file to modify the lights on [in] the watches enterprise,” Buonamassa Stigliani says.

Bulgari’s product-creation government director, Fabrizio Buonamassa Stigliani; Bulgari Octo Finissimo Extremely in platinum.

Courtesy of Bulgari

The drive to convey one thing thrilling and unique to market is fueling a rush of latest concepts, many from neglected sources. Van Cleef & Arpels, as an example, infuses its 118 years of knickknack experience into wildly sophisticated automaton wristwatches and clocks behind intricate facades. In contrast to many conventional watchmaking homes, Van Cleef typically leads with design and storytelling, with technical improvement serving because the means to show its fanciful imaginings into actuality.

I keep in mind very nicely once I mentioned, ‘Why does a consumer as we speak have to purchase a Bulgari watch?’

– Fabrizio Buonamassa Stigliani, Bulgari’s product-creation government director

The corporate has been creating advanced automaton timepieces since 2006; its most up-to-date instance, Brise d’Été, boasts a area of grass and violets that seem to waft gently within the wind. A pair of butterflies crossing above point out time on a retrograde time scale. “What’s attention-grabbing there for us—moreover the thought of the poetry of time, which is why we name these watches Poetic Problems—is that after we began to work on these tasks, we came upon that they had been technically very, very advanced,” says Nicolas Bos, the previous world president and CEO of Van Cleef & Arpels who’s now the CEO of its dad or mum firm, Richemont. Van Cleef spent seven years growing desk clocks that offered the identical ideas on a a lot grander scale. The primary instance, Automate Fée Ondine, got here to life in a whimsical scene set with a jeweled fairy resting atop a lily pad. “It required the experience and inventiveness of round 20 workshops in France and Switzerland to plan this extraordinary objet,” says Bos.

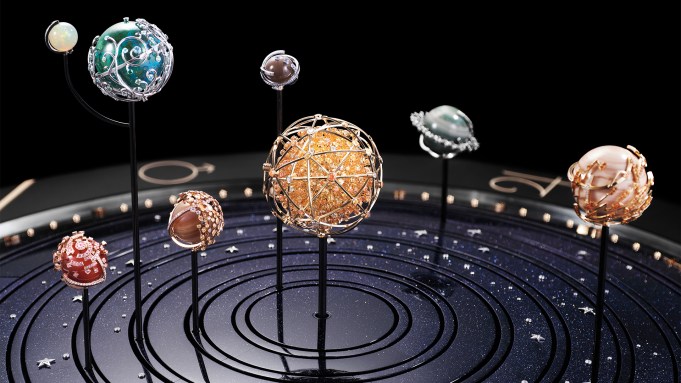

Masterminding creations at this stage additionally requires in-house wizards, and lots of manufacturers have strengthened their groups with a purpose to assemble much more superior timepieces. When Van Cleef & Arpels director of analysis and improvement Rainer Bernard joined the corporate from Piaget in 2011, he was one among simply 4 folks employed to speed up the watchmaking imaginative and prescient. Now, staff headcount is at 20. Bernard says the fantastical concepts dreamed up by the home foster new mechanical achievements. “It truly will get us to locations, technical locations, the place no person has been,” he says. “Because of this, for some time, we created between three to 5 patents yearly.” These achievements aren’t for bragging rights on technicality however somewhat milestones resulting in the creation of museum-worthy items. Take as an example the model’s magnum-opus desk clock, the Planétarium—a wonderland of rotating jeweled planets in a chunk measuring almost 20 inches excessive by 26 inches in diameter—the place every sphere strikes at its real pace of rotation set to a melody created with Michel Tirabosco, a Swiss musician and live performance artist. It reportedly had a price ticket of virtually $10 million. “Since I’ve been right here, with all the weather we put into place, we have now extra instruments and extra potentialities to actually create and be loopy about our tales,” Bernard says. “So, we are able to do issues we solely dreamed of a few years in the past.”

Van Cleef & Arpels Planétarium automaton clock.

Courtesy of Van Cleef & Arpels

The competitors to wow collectors has turn into so stiff that, for some, hiring internally now not suffices. As an alternative, luxurious labels are snapping up revered Swiss manufactures complete or investing in smaller unbiased manufacturers with elite experience. Bulgari was an early pioneer of the follow, buying Gérald Genta and Daniel Roth in 2000. Buonamassa Stigliani joined the corporate just some months later and says the acquisitions had been key to Bulgari’s watchmaking progress. “It’s true that we discovered a tremendous savoir faire, nevertheless it’s additionally true that we spent an enormous, enormous effort to realize these outcomes, as a result of the thought was to have new actions,” he says. “The thought was to purchase high-horology manufactures to seek out our path and to be the proprietor of our future.”

It truly will get us to locations, technical locations, the place no person has been.

– Rainer Bernard, Van Cleef & Arpels director of analysis

Having to supply actions from outdoors manufactures poses a number of issues, together with an absence of exclusivity and the potential for provide delays. However most significantly, bragging rights are sometimes reserved for corporations that create their very own. In-house manufacturing is a play for a rarefied, well-versed clientele. “You need to use a distinct language,” Buonamassa Stigliani says of interesting to severe connoisseurs. “You need to speak concerning the motion. You need to speak about technical constraints. The collector doesn’t speak with you when you’re speaking nearly shapes.”

Chanel has adopted an identical path, making acquisitions which are each prestigious and technically adept. In 1993 it bought G&F Châtelain, identified for producing high-quality circumstances and actions, and in 2019 it acquired a minority curiosity in Swiss motion producer Kenissi, an necessary provider of sapphire-crystal glass to the business. (Rolex is the principle shareholder by way of its subsidiary, Tudor.) Chanel additionally owns stakes in Bell & Ross, Romain Gauthier—which helped Chanel develop its first complication, a leaping hour, within the Monsieur watch from 2016—and F. P. Journe. In August of this 12 months, the Parisian home introduced a shock funding in avant-garde darling MB&F.

“Clearly, we’re making our personal watches, however we’re additionally a provider to many, many different homes, and that’s all the time been very Chanel,” says Grangié. “It’s the identical factor with couture. The home owns many, many métiers—greater than 35 at this level. We work for all the nice names.”

Chanel J12 X-Ray from 2020.

Courtesy of Chanel

In fact, it wouldn’t be a luxurious showdown with out LVMH on the desk. In 2011, the conglomerate bought La Fabrique du Temps, a manufacture based by watchmakers Enrico Barbasini and Michel Navas, who reduce their tooth making ultra-high-end actions for Patek Philippe, amongst others. Primarily based in Meyrin, Switzerland, the atelier is staffed with designers, engineers, and craftsmen who create timepieces for Louis Vuitton, Gérald Genta, and Daniel Roth. It has enabled Louis Vuitton to make a few of its wildest and most creative watches, such because the latest Tambour Opera Automata—a $580,000 automaton watch, nominated for a Grand Prix d’Horlogerie de Genève prize—that pays tribute to the Sichuan Opera’s Bian Lian custom with a retrograde-minutes and jumping-hours perform. Such over-the-top items aren’t for wallflowers, and even the standard watch fanatic, however there’s no denying the sophistication of their calibers.

In the meantime, Jean Arnault, the 26-year-old son of LVMH honcho Bernard, has been onerous at work overseeing the creation of fantastically crafted, if barely extra sensible timepieces for Louis Vuitton, the place he’s the director of watches. Drew Coblitz, a Philadelphia-based alternative-asset-fund supervisor and seasoned watch collector, says he was within the Tambour Computerized when it got here out, however speaking to Arnault was what satisfied him to buy the timepiece. “You simply get the impression that he’s supersmart and detail-oriented and considerate product-design-wise—the entire 9 yards,” Coblitz says. “And the factor that he’s attempting to do, branding-wise, is simply actually onerous. It’s received to be one of many hardest issues to do in watchmaking.”

Louis Vuitton Tambour in yellow gold.

Courtesy of Louis Vuitton

He’s referring to the try and shift notion of Louis Vuitton from a vogue home to a maker of bona fide collector watches—and, with costs operating from roughly $23,000 to $200,000, shoppers ought to count on the form of top-notch watchmaking the home is delivering. Whereas a number of the high- horology items are for a flashier clientele, the Tambour and Escale traces are attracting collectors who, like Coblitz, care about finesse and nuance however desire a extra conventional look. “The quantity of little-detail nerd stuff within the Tambour is killer,” Coblitz says. “And that’s earlier than you flip it round, as a result of the motion ending could be very good.”

Creating this stage of ending on a series-production piece versus a restricted version such because the Tambour Opera Automata, although, is a stretch on sources, which suggests luxurious homes are sizing up extra manufactures so as to add to their rosters. Like Louis Vuitton, Hermès will not be content material to stay on the sidelines. This 12 months, for instance, it debuted the Arceau Duc Attelé, a feat of mechanical engineering that mixes a triple-axis tourbillon with a minute repeater—the crème de la crème of issues—with hammers charmingly crafted as horse heads. The newest business buzz circulating round longtime rivals Vuitton and Hermès, each famed predominantly for his or her premium leather-based items and purses, is their rumored competitors to purchase Vaucher, an elite Swiss manufacture identified for its high-quality watch actions and parts.

Hermès Arceau Duc Attelé triple-axis tourbillon and minute repeater in polished titanium.

Courtesy of Hermès

This summer season, it was introduced that area of interest watchmaker Parmigiani Fleurier and its community of subsidiary suppliers of watch elements, together with Vaucher, are collectively up on the market by their dad or mum firm, the Sandoz Household Basis. Hermès, which has owned a 25 p.c stake in Vaucher since 2006, could appear to be the logical suitor. However the home is now reportedly vying with LVMH for full possession of the manufacture, which additionally provides elements to different high-end watchmakers, together with Chopard and Richard Mille; LVMH-owned TAG Heuer additionally outsources its higher-end actions by way of Vaucher. Hermès, Vuitton, and Parmigiani declined to remark for this text, however whoever positive factors management of the prized facility could have leverage over a lot of its opponents, and will even turn into their major provider.

This 12 months, Hermès debuted the Arceau Duc Attelé that mixes a triple-axis tourbillon with a minute repeater.

As luxurious manufacturers proceed to develop their watchmaking prowess by absorbing and investing in smaller specialised companies, they pose a probably vital problem to the business. Chanel, for its half, sees the enterprise technique as a chance to push boundaries. “Your opponents, who’re additionally shoppers, will push you to develop issues that you’ll not do for your self,” says Grangié. “Then you definitely turn into higher at what you do, and also you handle to have a mannequin that can make your small business sustainable over the long run, as a result of you will have these shoppers as nicely. To us, it’s a win-win proposition.” However for more-established watchmaking homes, the creativity inherent to fashion- and jewelry-first homes, backed by Switzerland’s most interesting horological specialists, may current a significant risk.

Some are smart sufficient to maneuver past their consolation zones: Simply final month, Patek Philippe launched its first new assortment in 25 years, geared toward a youthful clientele. However Chanel, for one, is already barreling full steam forward. “Subsequent 12 months, you will notice one thing extraordinary that took a very long time within the making,” hints Grangié. “We’re creating an ecosystem to help our enterprise and our future ambitions that depends on both the very best stage of experience or unbelievable names that we have now turn into related to first.” With historic homes looking for to draw recent consideration simply because the fashion-forward upstarts hit their stride with never-before-seen improvements, we simply is likely to be getting ready to a outstanding new period in luxurious watchmaking.