Beshom Holdings Berhad (KLSE:BESHOM) has had a tough three months with its share worth down 5.3%. To resolve if this development may proceed, we determined to take a look at its weak fundamentals as they form the long-term market developments. Particularly, we determined to check Beshom Holdings Berhad’s ROE on this article.

ROE or return on fairness is a useful gizmo to evaluate how successfully an organization can generate returns on the funding it obtained from its shareholders. In less complicated phrases, it measures the profitability of an organization in relation to shareholder’s fairness.

View our newest evaluation for Beshom Holdings Berhad

How To Calculate Return On Fairness?

The formulation for return on fairness is:

Return on Fairness = Internet Revenue (from persevering with operations) ÷ Shareholders’ Fairness

So, based mostly on the above formulation, the ROE for Beshom Holdings Berhad is:

3.2% = RM11m ÷ RM327m (Based mostly on the trailing twelve months to July 2024).

The ‘return’ is the yearly revenue. So, which means that for each MYR1 of its shareholder’s investments, the corporate generates a revenue of MYR0.03.

Why Is ROE Necessary For Earnings Development?

Up to now, we have now discovered that ROE measures how effectively an organization is producing its income. Based mostly on how a lot of its income the corporate chooses to reinvest or “retain”, we’re then capable of consider an organization’s future skill to generate income. Typically talking, different issues being equal, companies with a excessive return on fairness and revenue retention, have a better progress fee than companies that don’t share these attributes.

Beshom Holdings Berhad’s Earnings Development And three.2% ROE

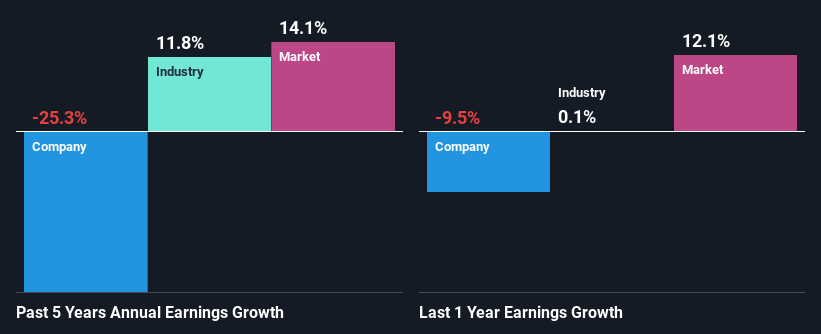

It’s fairly clear that Beshom Holdings Berhad’s ROE is relatively low. Not simply that, even in comparison with the business common of 16%, the corporate’s ROE is totally unremarkable. For that reason, Beshom Holdings Berhad’s 5 yr web revenue decline of 25% isn’t a surprise given its decrease ROE. Nonetheless, there is also different elements inflicting the earnings to say no. For example, the corporate has a really excessive payout ratio, or is confronted with aggressive pressures.

That being mentioned, we in contrast Beshom Holdings Berhad’s efficiency with the business and had been involved after we discovered that whereas the corporate has shrunk its earnings, the business has grown its earnings at a fee of 12% in the identical 5-year interval.

Earnings progress is a big consider inventory valuation. It’s essential for an investor to know whether or not the market has priced within the firm’s anticipated earnings progress (or decline). By doing so, they’ll have an thought if the inventory is headed into clear blue waters or if swampy waters await. Is BESHOM pretty valued? This infographic on the corporate’s intrinsic worth has every part you must know.

Is Beshom Holdings Berhad Utilizing Its Retained Earnings Successfully?

Beshom Holdings Berhad has a excessive three-year median payout ratio of 85% (that’s, it’s retaining 15% of its income). This implies that the corporate is paying most of its income as dividends to its shareholders. This goes a way in explaining why its earnings have been shrinking. The enterprise is just left with a small pool of capital to reinvest – A vicious cycle that does not profit the corporate within the long-run. To know the two dangers we have now recognized for Beshom Holdings Berhad go to our dangers dashboard free of charge.

Furthermore, Beshom Holdings Berhad has been paying dividends for not less than ten years or extra suggesting that administration should have perceived that the shareholders want dividends over earnings progress. Current analyst estimates counsel that the corporate’s future payout ratio is anticipated to drop to 61% over the following three years. Accordingly, the anticipated drop within the payout ratio explains the anticipated enhance within the firm’s ROE to six.4%, over the identical interval.

Abstract

On the entire, Beshom Holdings Berhad’s efficiency is sort of an enormous let-down. As a result of the corporate will not be reinvesting a lot into the enterprise, and given the low ROE, it isn’t shocking to see the shortage or absence of progress in its earnings. With that mentioned, we studied the most recent analyst forecasts and located that whereas the corporate has shrunk its earnings prior to now, analysts anticipate its earnings to develop sooner or later. Are these analysts expectations based mostly on the broad expectations for the business, or on the corporate’s fundamentals? Click on right here to be taken to our analyst’s forecasts web page for the corporate.

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to deliver you long-term centered evaluation pushed by basic information. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.